Composite Benefit Rates

Introduction

With the University 'going-live' with UC Path during Fiscal Year 2017-18, the way that HR and Payroll Services are handled will be significantly transformed from previous practices. One of the primary goals of UC Path is to steamline and standardize HR and Payroll processes for increased efficiency at the campus-level and consistency across other UC campuses.

One of the items being updated is how employee fringe benefits are assessed to internal, campus-based budgets and sponsored projects (fund awarded externally from agencies such as the National Science Foundation, National Institutes of Health, or U.S. Forest Service, for example). Specifically, the University will transition to a new costing methodology of assessing employee fringe benefits, which is called Composite Benefit Rates (or commonly referred to as CBRs).

To help ease this transition, the Costing & Policy Office has created this web-portal to provide resources that will assist during the budgeting process, which includes CBR identification, the costing method of certain benefit costs, and future projected rates.

What are Composite Benefit Rates?

(also known as CBRs)

CBRs are standard benefit rates developed each fiscal year and are used for business transactions containing a fringe benefit component. Our current practice assesses fringe benefits based on hundreds of detailed rates, and with the adoption of CBRs, individual employee fringe benefits will be assessed using only one of the five possible rates below:

| Projected Rates for Planning | |||||||

| Group No. | CBR Group | FY18* | FY19 | FY20 | FY21 | FY22 | FY23 |

|---|---|---|---|---|---|---|---|

| 1 | Faculty & Post-Doctoral Scholars | 40.0% | 40.3% | 40.7% | 41.1% | 41.6% | 42.0% |

| 2 | Other Academic & Exempt Staff | 45.5% | 46.0% | 46.4% | 46.9% | 47.4% | 47.9% |

| 3 | Limited Benefits Eligibiliity | 4.8% | 4.8% | 4.9% | 4.9% | 4.9% | 4.9% |

| 4 | Non-Exempt Staff | 56.5% | 57.0% | 57.4% | 57.8% | 58.3% | 58.8% |

| 5 | Food, Custodial, & Grounds Services | 80.3% | 80.8% | 81.2% | 81.7% | 82.2% | 82.6% |

| *FY2018 CBRs applicable during the period of December 1, 2017 to June 30, 2018 | |||||||

Please note that the CBRs for Fiscal Year 2018 are pending approval from our Cognizant Agency (DHHS). Projected rates (FY19-FY23) are estimates for planning purposes only (e.g., multi-year budgeting, contract and grant proposal submissions) and are subject to change.

If future approved composite fringe benefit rates are higher or lower than the projected rates budgeted at the proposal stage, PIs will need to re-budget accordingly.

How are CBRs Calculated?

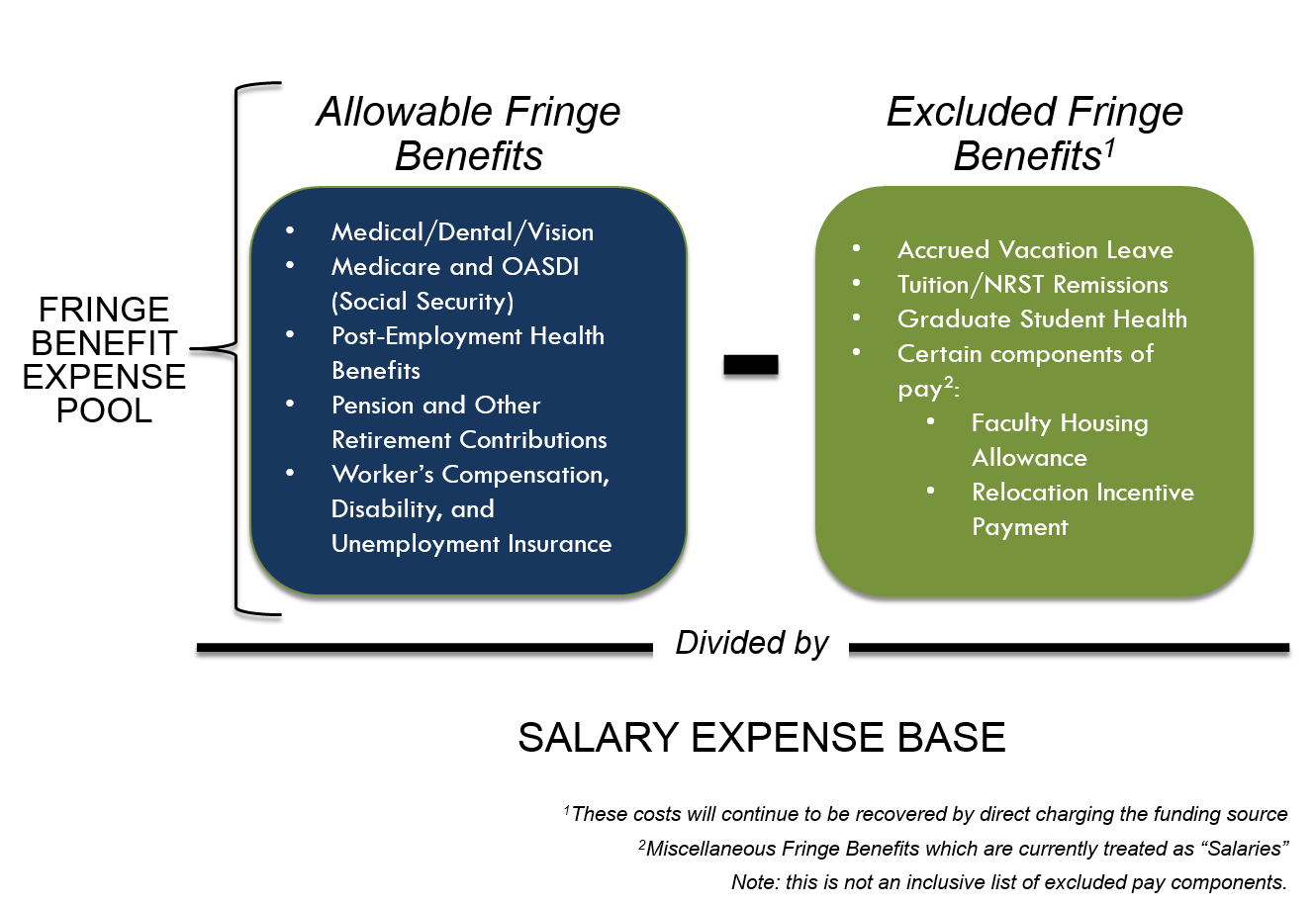

When compared to the current costing method for fringe benefits, the composite method is simplified and is computed using the following calculation model (current and future CBRs are calculated and managed centrally by UCOP and the Costing & Policy Office):

Please note that the fringe benefit costs that are excluded from the CBR calculation will still continue to be recoved by direct charging the applicable funding source. A complete list of these items can be found in the Budget Planning Guide located in the CBR Resources section of this web-page.

How do I know what CBR to use?

CBRs are assigned to employees by the looking at a few different attributes of their current appointment and benefits eligibility. Specifically, it will help in knowing the employee's;

- FLSA (fair labor standards act) Designation

- BELI (benefits eligibility) Status

- Current Title Code/DOS Code

If you need assistance in collecting this information, please contact your Management Services Officer/Business Officer.

To search for applicable CBRs by title code, please use the following web application below. To view this application in full-screen mode, please click on the 'Expand' arrow in the bottom-right corner of the frame below.

Mitigation Plan for Sponsored Awards

A mitigation plan to offset increased costs due to CBR implementation to existing sponsored awards is being drafted and reviewed. Detail on the mitigation plan will be presented at a later date.